This article was co-authored with Professor Joscimar Souza Silva from the Political Science Institute, University of Brasília

Brazil has been increasingly asserting its role on the global stage, seeking to become a key player in both political and economic affairs. The country is a prominent member of the BRICS group (Brazil, Russia, India, China, and South Africa), where it advocates for the reform of international economic institutions and the strengthening of economic ties among developing nations. Through BRICS, Brazil has been promoting multipolarity and greater representation for emerging economies in global governance. Brazil’s foreign policy has also shown a growing focus on expanding its influence in regions beyond Latin America. This strategic outreach is part of Brazil’s broader effort to diversify its international partnerships and assert its presence in global South-South cooperation frameworks. The relationship between Brazil and the countries of Central Asia, including Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan, is a fascinating example of cross-regional diplomacy and cooperation. Despite geographical distance and distinct historical trajectories, Brazil and Central Asian states have found common ground in promoting economic collaboration, cultural exchange, and multilateral diplomacy.

When it comes to Uzbekistan, despite historically modest trade volumes, the country’s economic relations with Brazil show significant growth potential. On August 17, 2015, the Agreement on Economic and Trade Cooperation between the Government of Uzbekistan and the Government of Brazil entered into force[1]. This agreement lays the foundation for strengthening bilateral trade and economic relations between the two countries. In 2023, the trade turnover between Uzbekistan and Brazil amounted to $656.6 million[2]. In 2023, Brazil’s imports from Uzbekistan amounted to approximately $413.1 million[3]. Brazil’s exports to Uzbekistan mainly include agricultural products such as sugar, tobacco, grains, and meat, as well as machinery and equipment[4]. In turn, Uzbekistan exports textiles, cotton, and plastics to Brazil.

The international financial institutions (IFIs) support Uzbekistan’s efforts to transition to a market economy, aiming to enhance private sector participation in key sectors and reduce state dominance. These reforms are expected to improve economic opportunities and facilitate trade growth with partners like Brazil, especially in agriculture and energy sectors. To support these efforts, the World Bank alone has provided financial assistance amounting to $800 million in concessional loans[5].

Brazil and Central Asia could engage in resource and expertise exchange in key sectors. Brazil could import oil and gas from Central Asia, while the region could benefit from Brazil’s advanced agricultural technologies. Central Asia is already exploring ways to diversify its economy and access new markets, making Brazil an attractive partner for trade and investment. Given that both parties have competitive export sectors, they can negotiate mutually beneficial trade agreements. Infrastructure development is another crucial area for potential cooperation. Brazil has extensive experience in implementing large-scale infrastructure projects—from roads and bridges to ports and railway networks. Some of the most significant infrastructure projects in Brazil include the Trans-Amazonian Highway (BR-230), the Port of Santos Expansion, the North-South Railway (Ferrovia Norte-Sul) and the São Francisco River Transposition Project. This expertise could be beneficial for Central Asian countries as they continue to develop their transportation systems and logistics infrastructure to enhance regional integration and attract international investments. In agriculture and major infrastructure projects, Brazil is also learning about the socio-environmental impacts and challenges of climate change, and is a pioneer in the transition to green energy[6].

Furthermore, Kazakhstan is the world’s leading uranium producer, largely through its national atomic company, Kazatomprom, could collaborate with Brazil in the field of energy. In 2023, Kazakhstan produced approximately 20,500 to 21,500 tons of uranium on a 100% basis, which represents the total production volume of all entities in which Kazatomprom has an interest[7]. This production is expected to increase to between 21,000 and 22,500 tons in 2024. Kazatomprom accounts for about 20% of the global primary uranium production, making it the largest producer in the world[8].

In the same vein, Turkmenistan is a significant player in the natural gas market. The country expanding its natural gas production to meet both domestic and international demands by increasing its gas production by an additional 60 billion cubic meters in the coming years[9]. The development of the Galkynysh gas field, one of the world’s largest, is central to this strategy[10]. This expansion will enable Turkmenistan to significantly boost its exports, including to new markets through strategic projects such as the Trans-Caspian Gas Pipeline. These initiatives present valuable opportunities for Brazil to invest in and partner with Turkmenistan in the energy sector.

Tajikistan has significant hydroelectric potential due to its mountainous terrain and numerous downstream rivers, while Brazil has extensive experience in hydroelectric power generation and renewable energy technologies. A notable example of Brazil’s expertise is the Itaipu Dam, shared between Brazil and Paraguay, one of the largest hydroelectric projects in the world, located on the Paraná River[11]. This dam, with a capacity of 14,000 megawatts[12], is a symbol of Brazil’s capability in managing complex hydropower infrastructure. Tajikistan, in turn, is developing the Rogun Dam, which, upon completion, will be the tallest dam in the world and have a generating capacity of 3,600 megawatts[13]. Collaboration between the two countries could involve technical support, best practices sharing, and strategic partnerships to optimize the construction and operation of large-scale hydro projects like Rogun. With regard to hydroelectric plants, it is essential to understand the socio-environmental impacts involved at all stages of the process, especially during implementation, the phase with the greatest risk[14].

Additionally, Brazil’s experience with smaller-scale hydro projects[15], which have been crucial in providing sustainable energy to rural areas, could be adapted to Tajikistan’s context. For example, Brazil’s development of mini and micro hydropower plants could be replicated in Tajikistan to electrify remote mountainous regions, thereby reducing reliance on fossil fuels. Furthermore, Brazil’s comprehensive approach to integrating renewable energy into its national grid—illustrated by programs like PROINFA[16], which promotes wind, biomass, and small hydro projects—could serve as a model for Tajikistan to diversify its energy portfolio. This collaboration would not only enhance Tajikistan’s energy capacity but also strengthen bilateral ties, leveraging Brazil’s expertise in sustainable energy solutions and Tajikistan’s natural hydropower resources.

In recent years, Central Asian countries have taken steps to improve trade conditions and reduce barriers for exports and imports. Within the framework of the B5+1 format, these countries aim to establish a free trade zone, which could open up additional opportunities for trade with Brazil and larger MERCOSUR trade block. Another potential aspect of bilateral relations could be cultural exchange and the development of educational programs. Establishing direct ties between universities in Brazil and Central Asia would enable students to exchange knowledge and experiences, conduct joint research, and open new opportunities for young professionals. Brazil already has experience participating in educational programs in other developing countries.

Cooperation could be carried out, for instance, within the framework of the program, which constitutes one of the key initiatives—the Post Graduate Student/ Covenant Program (PEC-PG). This program offers full PhD scholarships to professors, researchers, and professionals from developing countries that have cooperation agreements with Brazil in education, culture, science, and technology[17] in 112 public universities with free education and grants to encourage research and permanence in higher education and postgraduate studies. This program aims to enhance the qualifications of these professionals to support the development of their home countries. Cultural ties are also important to consider. Brazil is a country with a rich cultural heritage, while Central Asia has a remarkable cultural legacy, including contributions to science, art, and literature. Organizing joint cultural events such as exhibitions, concerts, and festivals could strengthen mutual understanding and stimulate tourism between the regions.

In addition to education and cultural exchange, collaboration on sustainable development is crucial. In the era of globalization, it is vital to address global challenges such as climate change, desertification, environmental pollution, and food security. Brazil is one of the world’s leading agricultural countries, specializing in the export of agricultural products such as soybeans, sugar, coffee, meat, and corn. Its expertise in agribusiness could be highly beneficial for Central Asian countries, many of which are still striving to modernize their agriculture and increase productivity. Uzbekistan and Kazakhstan, in particular, are major producers of cotton, wheat, and other agricultural products, but their agricultural sectors need innovative technologies and management systems to enhance efficiency.

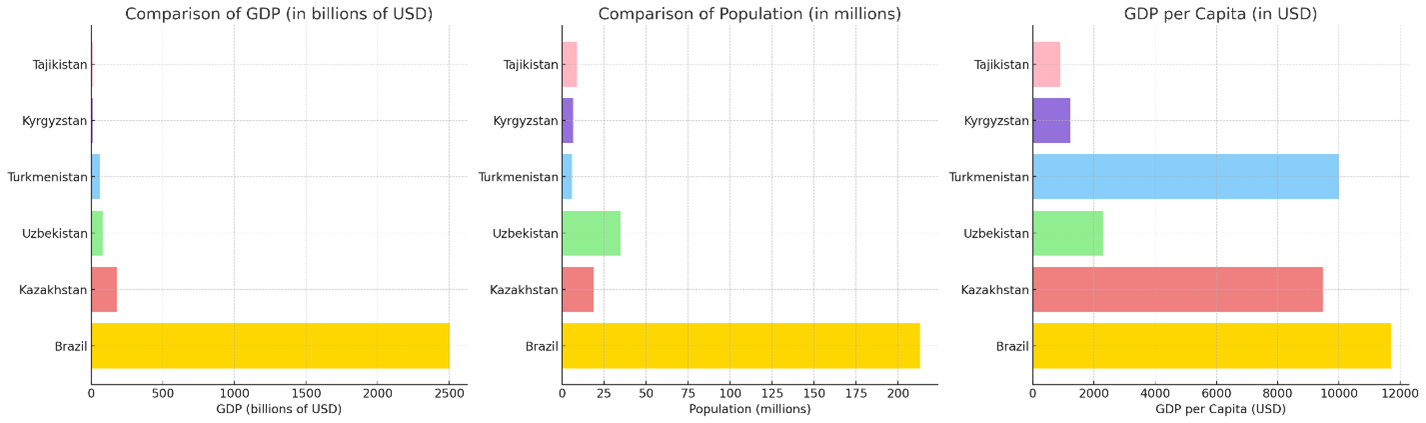

Figure 1: Comparison of the Economies of Brazil and CA Countries

In the last two decades, Brazil has also advanced in digital transformation. Today, Brazil has one of the most advanced electoral systems, using electronic ballot boxes since 2000, despite being a young democracy of just over 36 years[18]. It also has one of the most advanced banking and payment systems, as well as a broad program for offering and integrating digital public services, which include everything from digital personal signature services to advanced systems for transparency of public accounts via government websites and open data systems. Brazil’s long experience in digital transformation, given its population and economic size, can serve as a model for other countries, such as those in Central Asia.

In sum, specific cooperation areas between Brazil and Central Asia could include the following:

Despite the lucrative prospects, there are also challenges that need to be addressed to deepen cooperation between Brazil and Central Asia. One of the challenges is geographical distance. Both sides are located on different continents, and trade and economic ties may face logistical difficulties related to the transportation of goods and the organization of joint projects. More active diplomatic engagement is also required. This includes strengthening existing diplomatic channels, opening new embassies and trade missions, and intensifying intergovernmental negotiations. It is also essential to create favorable conditions for investors and simplify business procedures between countries. Nevertheless, the potential for growth and development of partnership relations between Brazil and the Central Asian countries is substantial. Cooperation in energy, agribusiness, tourism, education and digital transformation could significantly strengthen the economies of both regions and lead to mutual benefits on the global stage.

[1] https://www.norma.uz/novoe_v_zakonodatelstve/s_braziliey_ustanovlen_blagopriyatnyy_rejim_sotrudnichestva

[2] https://en.trend.az/casia/uzbekistan/3912963.html

[3] https://tradingeconomics.com/brazil/imports/uzbekistan

[4] https://tradingeconomics.com/brazil/exports/uzbekistan

[5]https://www.worldbank.org/en/news/press-release/2023/12/08/uzbekistan-s-transition-to-market-economy-to-accelerate-by-strategic-reforms-supported-by-the-world-bank

[6] https://agenciagov.ebc.com.br/noticias/202408/plano-unifica-acoes-de-estado-para-politica-energetica-mais-verde-e-inclusiva

[7]https://www.kazatomprom.kz/en/media/view/finansovie_rezultati_ao_nak_kazatomprom_za_1e_polugodie_2024_goda_i_obnovlenie_proizvodstvennih_planov_na_2025_god

[8]https://www.kazatomprom.kz/en/media/view/kazatomprom_4Q23_operations_and_trading_update

[9]https://turkmenistan.gov.tm/en/post/74532/turkmenistan-plans-increase-gas-production-60-billion-cubic-meters-near-future

[10]https://turkmenistan.gov.tm/en/post/74532/turkmenistan-plans-increase-gas-production-60-billion-cubic-meters-near-future

[11] https://www.itaipu.gov.br/en/nossahistoria

[12] https://www.itaipu.gov.br/en/nossahistoria

[13] https://www.power-technology.com/projects/rogun-hydropower-plant/

[14] https://periodicos.unb.br/index.php/sust/article/view/40635/33074

[15] https://energypedia.info/wiki/Small_Hydro_Power_(SHP)_Brazil_-_Institutional_Set-up

[16]https://www.researchgate.net/publication/224384110_The_Brazilian_Renewable_Energy_Incentive_Program_-_The_Second_Phase_of_the_PROINFA_Assessing_Policy_Efficiency_And_Barriers_in_Long-term_Scenarios

[17]https://www.gov.br/capes/en/access-to-information/actions-and-programs/scholarships-and-students/international-cooperation-programs/multinational/post-graduate-student-covenant-program-pec-pg

[18] https://www.tse.jus.br/comunicacao/noticias/2023/Janeiro/urna-eletronica-de-2000-permitiu-a-primeira-eleicao-100-informatizada

Download the article below