The conflict between Israel and Iran, despite its regional nature, has the potential to cause global turmoil in the oil market. Escalating tensions in the strategically important Middle East region threaten the stability of oil supplies and, in extreme scenarios, could cause price shocks comparable to the oil crises of the 1970s.

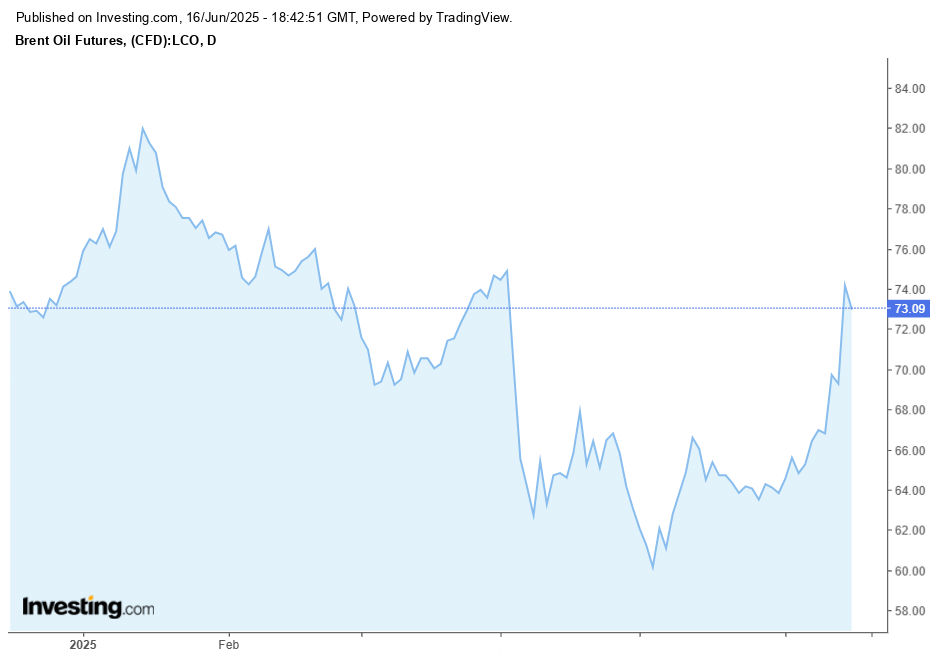

If the military confrontation develops along the lines of the previous exchange of blows – that is, short-term, without significant infrastructure losses and the involvement of third countries – the oil market's reaction will be restrained. An example of this is the episode in the spring of 2024, when, after exchanges of blows on targets in Syria, Iraq and Iran, oil prices temporarily rose by $3-5 per barrel, but returned to their previous levels within a week.

In such situations, the market factors a ‘geopolitical premium’ into the price, but quickly adjusts when it becomes clear that there is no threat to actual supplies. This is especially true given that Iran supplies about 1–1.5 million barrels per day to the external market, which is a significant but not critical volume, especially since it goes mainly to China, which has its own strategic reserves.

A scenario in which the conflict drags on and Iran's oil refineries, export terminals and pipelines are hit poses a much greater threat. In this case, the market will face a real reduction in supply, which could trigger a jump in prices to $100–150 per barrel.

There have been precedents of this kind: the drone attack on Saudi Aramco facilities in September 2019 led to the loss of almost 5% of global supplies and caused a one-off 19% increase in Brent crude oil prices (the sharpest jump since 1991). Although the situation was quickly resolved, it highlighted the vulnerability of infrastructure even in highly protected countries.

Given the limited ability to increase production in the short term, even for OPEC+ countries, and the possible tightening of sanctions against Iran, it will be difficult for the market to quickly make up for the loss of even 1–1.5 million barrels per day.

The most critical scenario involves the closure or military blockade of the Strait of Hormuz, a strategic ‘oil bottleneck.’ Between 20 and 21 million barrels of oil pass through this narrow section between Oman and Iran every day, which is about one-fifth of total global consumption.

Iran has repeatedly threatened to block the strait in the event of military aggression. If such a threat becomes a reality, even for a few days, oil prices could rise sharply to $200-300 per barrel. In the event of a large-scale naval blockade, insurance companies refusing to operate in the region and tanker traffic coming to a halt, even more extreme figures are theoretically possible — $500-1000 per barrel — although these seem hypothetical in the short term.

This would create a domino effect:

Despite the dramatic potential for developments, a number of factors may constrain explosive price growth:

At the moment, the oil market is living on expectations. If the conflict between Israel and Iran remains limited, the price increase will be short-term and moderate. However, its prolongation or the involvement of third countries (e.g., the US, Saudi Arabia, the UAE) could radically change the picture.

The key risk is the Strait of Hormuz. Its closure, even for a few days, would trigger an energy shock and global inflation. Therefore, despite all the scenarios, the world's leading countries are making efforts to prevent the situation from escalating to that level.

* The Institute for Advanced International Studies (IAIS) does not take institutional positions on any issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of the IAIS.